Launch Your Faith Community as a 501(c)3 Nonprofit:

100% Done-For-You Religious Nonprofit Formation

Whether you’re starting a church, synagogue, mosque, temple, or a non-traditional house of worship, we’ll help you secure 501(c)(3) status the right way.

Our proven process gets you the ideal outcome - simple, fast, and worry-free.

All Startup Costs are Tax Deductible

Trusted by 5,000+ Nonprofits Operating Worldwide

Established or Just Starting Out — We Can Help.

Already have a congregation but never filed for 501(c)(3)?

Or just starting out with a new spiritual community?

With IRS-recognized 501(c)(3) status you can:

Establish Your Religious Organization in 3 Simple Steps!

1. Sign up for our Faith Community-Specific 501(c)(3) Launch Package

Select the Enterprise plan, specifically designed for churches and religious organizations.

2. Provide Information About Your Traditions and Activities

Share your religious purpose, doctrinal beliefs and/or traditions, and organizational details. Takes 47 minutes on average.

3. Relax! We Handle Everything Else

You'll receive updates, approved documents & your IRS 501(c)3 determination letter. We specialize in fast, trouble-free approvals, even for alternative expressions of faith!!

Most church founders complete their part to establish and incorporate in 17 minutes, and complete the tax-exemption phase in less than one hour!

What's Included In Your Religious 501(c)3 Launch Package?

(Everything your faith community or spiritual house needs to thrive!)

1. Complete State & Federal Filings for Churches

All the documentation that satisfies both IRS and state requirements...

✓

Articles of Incorporation in your State (as required)

✓ EIN - Employer Identification Number for banking & donations

✓ IRS Form 1023 Application + Schedule A - required for houses of worship

✓ Custom-Tailored Narrative of Activities to articulate statement of faith and meet requirements for tax-exempt status

✓

IRS-Friendly Bylaws, Conflict of Interest and Governance policies

✓ Statement of Faith and doctrinal requirements

✓ Expedited processing of every filing

2. Religious Organization Nonprofit Founder's Playbook

Because "Comprehensive Religious Nonprofit Governance" doesn't inspire...

Here's what pastors and leaders of spiritual communities love most:

✓ How to receive tax-deductible donations immediately

✓ Board recruitment & management guidance and template documents

✓ Tools, templates, training & tips to ease ongoing management burdens

✓ IRS compliance made simple, including Form 990 Tax Return (optional)

✓ Grant readiness training for faith-based funding

...And much more

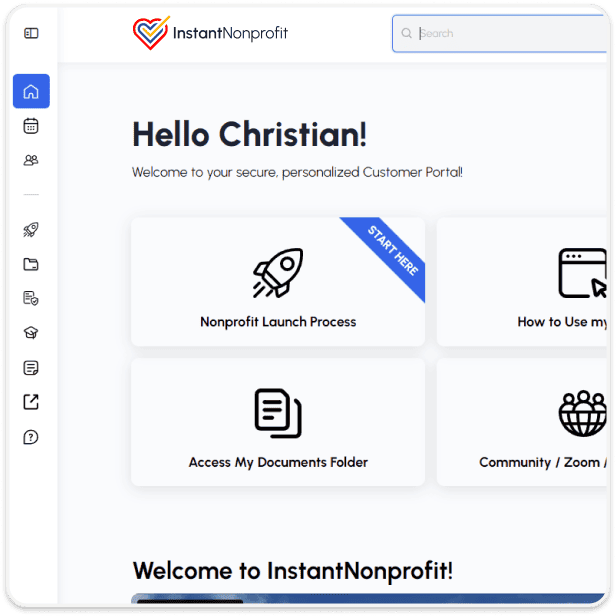

3. Your Mission HQ Portal

One-stop access to everything your religious organization needs.

✓ All Approved Nonprofit Documents for your house of worship.

✓ Nonprofit Training Library

✓ Church Board Meeting Templates & training

✓ Faith-Based Fundraising Resources

✓ Growing FAQ & Knowledge Base for church founders

✓ Annual maintenance guidance to stay compliant

Don't take our word for it, see what our customers had to say about filing their 501(c)3 through Instant Nonprofit!

All Orders Include a 200% IRS 501(c)3 Approval Guarantee

Receive your religious organization approval, or get DOUBLE your money back. End of story.

You've got the calling to serve. We've got the roadmap to make your church or religious organization 501(c)3 official with the IRS.

Here's the truth: Too many powerful Churches get stuck in IRS paperwork instead of changing lives. Church founders spend months trying to navigate Form 1023, religious qualification requirements, and state coordination, time that should be spent serving your congregation and community.

We've helped over 5,000 mission-driven founders launch legitimate nonprofits without the bureaucratic maze. We understand exactly what the IRS requires from religious organizations.

For churches, it's not just about paperwork, it's about proving religious purpose, maintaining doctrinal autonomy, and meeting specific requirements that protect your Church's freedom.

We handle every detail, file every form, and ensure every religious requirement is met. If the IRS doesn't approve your church's nonprofit status? You get 200% of your money back. No exceptions.

Ready to make your Church 501(c)3 official with the IRS?

Rest Assured With Our 5-Point Quality Guarantee Included With All Plans...

✓ 200% IRS Approval Guarantee for Churches:

We don't just file, we deliver. From vision to verified religious organization, or you get double your money back.

✓ Zero Religious Compliance Confusion:

You focus on Church. Our specialists handle all religious-specific requirements, IRS coordination, and state filings.

✓ Truly Done-For-You Church Nonprofit Formation:

Sign up. Complete your Church profile. Approve the plan. Most church leaders finish in 90 minutes. We handle everything else.

✓ No Hidden Fees, No Surprises:

Crystal clear pricing with no religious organization "gotchas" or surprise compliance costs.

✓ Religious Freedom Protection:

Your specialist understands churches, religious organizations, and how to maintain your doctrinal autonomy throughout the process.

start, grow & manage

Start and Grow Your 501(c)3 with Instant Nonprofit

Expert customer service. By real humans who care about your mission.

FAQs for Church & Religious Organization Founders

Have questions about something else? Check out our Help Center or email us at support@instantnonprofit.com

Not automatically! Churches must still apply and meet IRS requirements for religious organizations. However, they do have certain advantages and exemptions that we help you navigate properly.

The IRS requires churches to have: regular religious services, established congregation, recognized creed/doctrine, formal leadership structure, and regular religious education. We help document all of these properly.

The IRS requires churches to have: regular religious services, established congregation, recognized creed/doctrine, formal leadership structure, and regular religious education. We help document all of these properly.

Absolutely! 501(c)3 status actually provides additional protection for your religious practices. We ensure your application preserves your doctrinal autonomy while meeting IRS requirements.

Yes. All contributions to an IRS-approved church are fully tax-deductible for your donors.

Yes! We provide documentation that allows congregants to make tax-deductible donations right away. These become fully deductible retroactively once your 501(c)3 is approved.

Churches have specific guidelines about political activities. We include comprehensive training on what is allowed and what to avoid, so your ministry stays compliant while maximizing your impact.

Yes, the IRS requires a governing body. We help you structure a board that meets requirements while respecting your church's leadership structure and denominational practices.

The IRS recognizes a church if it has a pastor, a congregation, and holds regular services at a place of worship. We handle the incorporation, EIN, and IRS filings so your church is approved quickly and stress-free.

No. The IRS doesn’t set a legal minimum. What matters most is having a pastor, congregation, and regular services.

A church has a congregation, pastor, and services. Religious organizations (like ministries or missions) may be nonprofits but are not classified as churches by the IRS. Our Church Package is designed for true congregations.

You Lead the Congregation.

We’ll Handle the Paperwork.

Your calling is to preach, teach, and lead your people, not to fight through IRS paperwork.

We’ve helped over 5,000 pastors, planters, and nonprofit founders set up churches and religious organizations that last. Let’s make your church official, so you can focus on growing your congregation.