Excellent 4.8 out of 5

Stay focused on your mission

Set Your Nonprofit's Annual Maintenance Filings on Auto-Pilot

...get peace of mind and avoid legal fees

Designed to Save Time and Money by Eliminating the Need for Accountant or Attorney for Routine Annual Compliance

Why Join Nonprofit

Auto-Pilot?

Protect Your 501(c)3 Status

Since 2010, the IRS has revoked the 501(c)3 status of over 300,000 nonprofits, for failure to file the IRS Form 990.

Learn How to Run Your Nonprofit

Monthly Flight School monthly trainings help you build your skillsets- join & vote for what's next!

Year-Round Office Hours Support

Eliminate hefty lawyer, accounting or consultant Q&A fees - and get real answers on YOUR situation!

Trusted by 4000+ Nonprofits Operating Worldwide

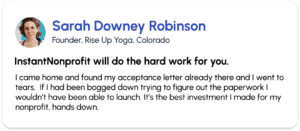

The IRS website is like a kick in the throat. I needed a solution for the huge paperwork problem.

InstantNonprofit does the heavy lifting, so you can focus on your purpose. It's the best investment I made for my nonprofit, hands down.

Sarah Downey Robinson

Founder, Rise Up Yoga, Denver

What's Included

Stay compliant with an annual time investment

of just 17 minutes a year!

Checking your compliance, confirming your status is in good standing and assessing your risk...

Stay Compliant with Done-For-You Annual Reports & Filings

To ensure you keep your tax-exempt status and stay compliant all year long...

Here the compliance forms we'll complete and file for you:

Training & Live Q&A

Our mission is to make doing good easy. That is why with every Instant Nonprofit Auto-Pilot membership, we are including two additional unique and powerful resources...

Content Deep Dive

Access the Ever-Growing Flight School Training Sessions with Auto-Pilot

As we add new lessons every month, you can up-vote the hottest topics and learn to take advantage of the latest productivity, operational and growth hacks on the planet!

Payroll Mastery: Building a Thriving Team

Unlocking 120,000/y USD Google Ad Grants

Pitch Power: Crafting Compelling Presentations

Website Build: Engaging Nonprofit Websites

Corporate Sponsorship Success

AI Empowerment for Non-Techies

Grant Readiness

Data-Driven Nonprofits

Year-End Fundraising Frenzy

Scrum-Tastic Productivity

"Not Boring" Board & Governance

End-of-Year Match Challenge Magic

With Instant Nonprofit Auto-Pilot...

You'll Have the Peace of Mind Of

Avoid the Traps & Red Tape Of

4 Reasons to Say YES

For the detail mavens out there, here’s…

The Nitty Gritty, The Kit And Kaboodle, The Whole Enchilada...

5 Point Inspection

1. IRS 990 Information Return Compliance Check (BOT)

2. State Corporate Good Standing Confirmation

3. Franchise Fee Business & Property Tax Liability Exposure Check

4. State Sales & Use Tax Exemption Needs Analysis

5. *Assess exposure for any regulations which includes your fundraising efforts and charitable solicitation registration recommendations.

Need assessment created to find out all ways that they are currently fundraising

Operational Costs, Revenue forecast, where are you fundraising, which states?

Provide different options based on answers

*(additional fees may be incurred at a discounted rate to get your account to good standing to move forward)

Ongoing Paperwork Support

1. Filing: *IRS Form 990N Annual Tax Return Filing

2. Filing: *State Annual/Periodic Report (Maintain Corporate Entity Good Standing)

3. *In California and Washington, special files are included (with custom pricing in those states)

Ongoing Education

- Fundraising Online - Stewardship

- Technology Stack - Will

- Media & Zoom Mastery - Amy Scruggs*

- FB Community - Jordan

- Bookkeeping - Expert

- How to Pitch - Expert

- Fundraising Mini-Class*

- Social Media - “All the little things” Expert

- Internally Organizing your Organization - Jordan

- Email Marketing - Build your Donor Pipeline-Will

- Consistency - Master Business Calendars - Expert

- Communications - How, what channels consistency, messaging “voice”

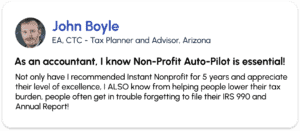

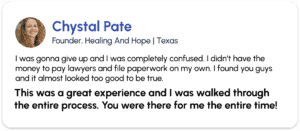

What Our

Customers Are

Saying...

Stay focused on your mission with the experts at Instant Nonprofit handling the IRS & state agencies over the next 12 months with auto-pilot.

How to get started

Easy, 3-Step Process

Step 1

Sign Up & Check Out

Step 2

We'll Confirm Organization Info

Step 3

Choose Your Best Path for Success!

Reduces work for most customers to 15 minutes per year, on average!

Just the FAQs...

For the past decade, the average IRS approval time ranged from 10 to 18+ months - but even with the Full 1023 Application for 501(c)3 Tax Exempt Status, Instant Nonprofit files average 4 - 6 months, eliminating 1/2 to 2/3 of the delay for our family of founders. At this time, the average approval time for Instant Nonprofit Streamlined customer applications is 4 to 8 weeks.

Over the course of filing thousands of 501(c)3's, we've built up a body of expertise when it comes to using the right formula for fast approval. Just as we promise to be as human as possible with our customers, we do the same with the good folks at the IRS.

InstantNonprofit offers basic fundraising training & resources, 100% free upon purchase of one of our 501(c)3 Formation packages.

We also offer professional fundraising training through a long-time partner, who raises tens of millions for a broad array of causes.

Finally, we have a growing list of vetted grant writers who are available for introductions.

Some customers approach InstantNonprofit for our services, hoping that they can utilize an LLC or other entity formed independently prior to engaging us.

It’s important to note that the LLC entity type is not compatible with a 501(c)3 nonprofit; if you mistakenly started an LLC for the purpose of taking a step toward starting a nonprofit, it will need to be dissolved (we can help with this).

The correct type of entity is the Nonprofit Corporation (called a Non-Stock corporation in Virginia).

It's also important to note that even in cases where the correct entity type was filed, there is also required addenda (Purpose and Dissolution Clause), without which the IRS will reject your application.

If you filed a Nonprofit Corporation but failed to add the required language prior to starting with us, don't worry! We'll carefully examine your documents and file the proper amendment at no charge (not including government fees).

Also any EIN that is or was assigned to another entity at any time is NOT able to be applied to your new nonprofit - a new one must be obtained.

The BEST thing to do is NOTHING - it's usually better to start fresh with InstantNonprofit - because we do it all FOR you!

Yes, you may choose to be reimbursed (your nonprofit can pay you back after it raises funds or receives a grant), or you can choose to write it off as a charitable donation on your personal or business income taxes.

Keep receipts for such expenditures, and it's wise to create a paper trail, such as an invoice or acknowledgement of the expense provided by the nonprofit to the source of funds.

The IRS has created two paths to 501(c)3 tax-exempt status based on expected donations:

Organizations confident that they will raise more than $50,000 in the current tax year, or any of the following two tax years (these qualify for our Enterprise Plan)

One for organizations with expected donations below $50,000/year (or do not have a clear path to exceed that amount (these qualify for our Express Plan)

About 88% of our customers qualify for Express, while the other 12% choose Enterprise. The IRS 501(c)3 designation is the same.

If you choose the Express Plan and then exceed your wildest fundraising dreams, there is no penalty, and you do not have to re-file a thing! You will simply report your donations to the IRS in the following year as normal.

Your investment in service fees and government filing fees is visible on the following page when you click "get started".

Yes. You can build a strategic partnership with your for-profit and nonprofit, however, your nonprofit will be set up as it’s own entity and operate separately from your for-profit.

Nothing.

While the Enterprise package is designed for larger organizations that anticipate donations exceeding $50,000 in years 1, 2 or 3, and the Express is for organizations expeting to fall below $50,000, there are no penalties for Express customers who exceed those numbers.

The IRS does not come back and make you file another application. You simply must report your revenues on the appropriate 990 tax form.

Rest Easy With Our

5-Point Quality Guarantee

Ensure you maintain your tax-exempt status and stay compliant all year! Take our quiz for customized pricing based on your needs.

Don't worry! Everything is backed by our 5-Point Quality Guarantee.