Launch Your Nonprofit with Our 501(c)3 Services

The Most Comprehensive Nonprofit Packages on Earth

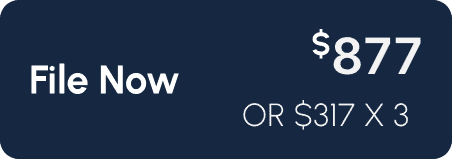

For organizations projecting bank deposits of less than $50k (or unknown amount) in any of initial 3 years (not church or school)

$877

or $317 x 3

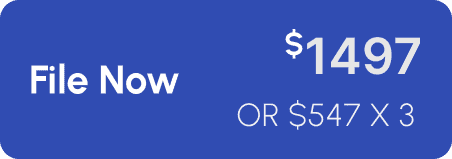

For organizations anticipating bank deposits (of any kind) of MORE than $50k in any of initial 3 years (also required if a church / school)

$1497

or $547 x 3

*For Special Nonprofits with a Single Source of Funding

$1997

or $737 x 3

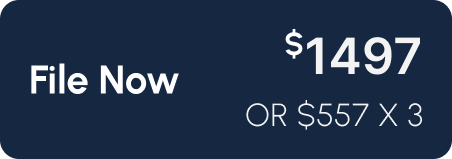

*For Chambers of Commerce, Issue Advocacy, etc. Only

$1497

or $557 x 3

Watch the Video to Find out Which Package You Need

Compare PackagesIdentify the InstantNonprofit package and services that fit your needs and let's get started! | Express | Enterprise | Private Foundation* | 501(c)4, (c)6 or other |

|---|---|---|---|---|

Best For: | For Small & Local Nonprofits Projecting Less than $50k/yr | For Church, School or Nonprofits Projecting Income Over $50k/yr+ | *For Special Nonprofits with a Single Source of Funding | *For Chambers of Commerce, Issue Advocacy, etc. Only |

Make it official | Cell | |||

Verify Nonprofit Business Name Availability | ||||

Prepare and File of Articles of Incorporation | ||||

Append IRS-required Dissolution & Purpose Language | ||||

Customized IRS-Friendly Bylaws | ||||

Obtain Federal Tax ID Number (EIN) | ||||

Obtain IRS 501(c)3 Tax Exempt Status | Cell | |||

IRS 1023-EZ Application for Tax-Exempt Status (fast approval) | Cell | Cell | ||

IRS 1023 Long- Form Application w/Schedules (as applicable) | Cell | |||

IRS 1024 Application w/Schedules (as applicable) | Cell | Cell | ||

Structure & Edit IRS Form 1023 Narrative of Activities (speeds long-form approval) | ||||

Create & Attach Detailed 1023 Application Addenda (speeds long-form approval) | ||||

IRS-Friendly Conflict of Interest & Compensation Policy | ||||

Board / Corporate Governance Made Easy | Cell | |||

Board Meeting Minutes & Resolutions (Customized to your Organization) | ||||

Board Recruitment/Consent to Serve/Board Changes Documents & Training | ||||

Memo on Retroactive Deductibility (raise funds prior to IRS Approval) | ||||

Personalized, Expert Services | Cell | |||

Mission HQ Portal Access: Your One Stop for Documents, File Status, Training & Support | ||||

High-Priority IRS Application Packaging & Processing | ||||

Our Staff Manages Any & All Unexpected/Additional IRS Information Requests (as applicable) | ||||

Office Hours & Support from Your Nonprofit Specialist Team | ||||

200% Money-Back IRS Approval Guarantee | ||||

Everything Conveniently Located in Your Mission HQ Portal | Cell | |||

7-Step Guided Experience: Our Process and Your Steps for Success | ||||

Secure Cloud Storage Backup for all Documentation | ||||

Relevant "Ask us Anything" Interactive Office Hours (save legal & accounting fees) | ||||

Fundraising Video Training with Downloads, Tools & Templates | ||||

Board of Directors Meeting & Management Training | ||||

Corporate Governance Video Training | ||||

Compliance & Annual Maintenance Video Training |

Secure Your Investment with Nonprofit Auto-Pilot | Cell | Cell | Cell |

100% Done-for-You Managed Annual Entity & 990 Tax Filings | Cell | Cell | Cell |

Mission HQ Portal: Continued Access to Everything Listed Above, plus: | Cell | Cell | Cell |

Flight School: New Training Content Added Monthly (request and vote on topics!) | Cell | Cell | Cell |

Running Your Nonprofit Back-Office: Management Tools Training | Cell | Cell | Cell |

Technology & Website Training | Cell | Cell | Cell |

Optional - add Expert Training & Coaching

With Evolved Acceleration

sign up for your package, then ask your specialist How to apply for evolved

Iconic Income: Major Gifts Fundraising Training & Coaching Program - the fastest path to cash for your organization

Iconic Impact: A-to-Z Organizational Capacity-Building Training & Coaching

Impact Assessment & roadmap: Unlock Your Potential & Drive Results, with 1:1 Personalized coaching

Advanced Mastermind Membership 1 year

Compare PackagesIdentify the InstantNonprofit package and services that fit your needs and let's get started! | Express | Enterprise | Private Foundation | 501(c)4 |

|---|---|---|---|---|

Top Features | For Small & Local Nonprofits | For Larger Budget Nonprofits | Accelerate Your Progress and Impact | Accelerate Your Progress and Impact |

Make it official | Cell | |||

Verify Nonprofit Business Name Availability | ||||

Prepare and File of Articles of Incorporation | ||||

Append IRS-required Dissolution & Purpose Language | ||||

Customized IRS-Friendly Bylaws | ||||

Obtain Federal Tax ID Number (EIN) | ||||

Obtain IRS 501(c)3 Tax Exempt Status | Cell | |||

IRS 1023-EZ Application for Tax-Exempt Status (fast approval) | ⓘ

Evolved: as applicable depending on Express/1023-EZ or Enterprise/Long-Form 1023

| |||

IRS 1023 Long- Form Application w/Schedules (as applicable) | ⓘ

Evolved: as applicable depending on Express/1023-EZ or Enterprise/Long-Form 1023

| |||

Structure & Edit IRS Form 1023 Narrative of Activities (speeds long-form approval) | ⓘ

Evolved: as applicable depending on Express/1023-EZ or Enterprise/Long-Form 1023

| |||

Create & Attach Detailed 1023 Application Addenda (speeds long-form approval) | ⓘ

Evolved: as applicable depending on Express/1023-EZ or Enterprise/Long-Form 1023

| |||

IRS-Friendly Conflict of Interest & Compensation Policy | ||||

Board / Corporate Governance Made Easy | Cell | |||

Board Meeting Minutes & Resolutions (Customized to your Organization) | ||||

Board Recruitment/Consent to Serve/Board Changes Documents & Training | ||||

Memo on Retroactive Deductibility (raise funds prior to IRS Approval) | ||||

IRS-Friendly Conflict of Interest & Compensation Policy | ||||

Personalized, Expert Services | Cell | |||

Mission HQ Portal Access: Your One Stop for Documents, Status & Training | ||||

Expedited IRS Application Packaging & Processing | Cell | |||

Our Staff Manages Any & All Additional IRS Information Requests (as applicable) | Cell | |||

Office Hours & Support from Your Nonprofit Specialist Team | Cell | |||

200% Money-Back IRS Approval Guarantee | Cell | |||

Everything Conveniently Located in Your Mission HQ Portal | Cell | |||

7-Step Guided Experience: Our Process and Your Steps for Success | Cell | |||

Secure Cloud Storage Backup for all Documentation | Cell | |||

Relevant "Ask us Anything" Interactive Office Hours (save legal & accounting fees) | Cell | |||

Fundraising Video Training with Downloads, Tools & Templates | Cell | |||

Board of Directors Management Training | Cell | |||

Corporate Governance Video Training | Cell | |||

Compliance & Annual Maintenance Video Training | Cell | |||

Expert Training & Coaching for Results | Cell | |||

Iconic Income: Major Gifts Fundraising Training & Coaching Program | Cell | |||

Iconic Impact: A-to-Z Organizational Capacity-Building Training & Coaching | Cell | |||

Impact Optimization Blueprint: Unlock Your Potential & Drive Results | Cell | |||

6-Month Mastermind Membership | Cell |

Secure Your Investment with Nonprofit Auto-Pilot | Cell | Cell | Cell |

100% Done-for-You Managed Annual Entity & 990 Tax Filings | Cell | Cell | Cell |

Mission HQ Portal: Continued Access to Everything Listed Above, plus: | Cell | Cell | Cell |

Flight School: New Training Content Added Monthly (request and vote on topics!) | Cell | Cell | Cell |

Running Your Nonprofit Back-Office: Management Tools Training | Cell | Cell | Cell |

Technology & Website Training | Cell | Cell | Cell |

Top Features | For Small & Local Nonprofits | For Larger Budget Nonprofits | Accelerate Your Progress and Impact |

|---|---|---|---|

Make it official | |||

Verify Nonprofit Business Name Availability | |||

Prepare and File of Articles of Incorporation | |||

Append IRS-required Dissolution & Purpose Language | |||

Customized IRS-Friendly Bylaws | |||

Obtain Federal Tax ID Number (EIN) | |||

Obtain IRS 501(c)3 Tax Exempt Status | |||

IRS 1023-EZ Application for Tax-Exempt Status (fast approval) | ⓘ

Evolved: as applicable depending on Express/1023-EZ or Enterprise/Long-Form 1023

| ||

IRS 1023 Long- Form Application w/Schedules (as applicable) | ⓘ

Evolved: as applicable depending on Express/1023-EZ or Enterprise/Long-Form 1023

| ||

Structure & Edit IRS Form 1023 Narrative of Activities (speeds long-form approval) | ⓘ

Evolved: as applicable depending on Express/1023-EZ or Enterprise/Long-Form 1023

| ||

Create & Attach Detailed 1023 Application Addenda (speeds long-form approval) | ⓘ

Evolved: as applicable depending on Express/1023-EZ or Enterprise/Long-Form 1023

|

Obtain IRS 501(c)3 Tax Exempt Status | |||

IRS 1023-EZ Application for Tax-Exempt Status (fast approval) | ⓘ

Evolved: as applicable depending on Express/1023-EZ or Enterprise/Long-Form 1023

| ||

IRS 1023 Long- Form Application w/Schedules (as applicable) | ⓘ

Evolved: as applicable depending on Express/1023-EZ or Enterprise/Long-Form 1023

| ||

Structure & Edit IRS Form 1023 Narrative of Activities (speeds long-form approval) | ⓘ

Evolved: as applicable depending on Express/1023-EZ or Enterprise/Long-Form 1023

| ||

Create & Attach Detailed 1023 Application Addenda (speeds long-form approval) | ⓘ

Evolved: as applicable depending on Express/1023-EZ or Enterprise/Long-Form 1023

| ||

IRS-Friendly Conflict of Interest & Compensation Policy |

Board / Corporate Governance Made Easy | |||

Board Meeting Minutes & Resolutions (Customized to your Organization) | |||

Board Recruitment/Consent to Serve/Board Changes Documents & Training | |||

Memo on Retroactive Deductibility (raise funds prior to IRS Approval) |

Personalized, Expert Services | |||

Mission HQ Portal Access: Your One Stop for Documents, Status & Training | |||

Expedited IRS Application Packaging & Processing | |||

Our Staff Manages Any & All Additional IRS Information Requests (as applicable) | |||

Office Hours & Support from Your Nonprofit Specialist Team | |||

200% Money-Back IRS Approval Guarantee |

Everything Conveniently Located in Your Mission HQ Portal | |||

7-Step Guided Experience: Our Process and Your Steps for Success | |||

Secure Cloud Storage Backup for all Documentation | |||

Relevant "Ask us Anything" Interactive Office Hours (save legal & accounting fees) | |||

Fundraising Video Training with Downloads, Tools & Templates | |||

Board of Directors Management Training | |||

Corporate Governance Video Training | |||

Compliance & Annual Maintenance Video Training |

Expert Training & Coaching for Results | |||

Iconic Income: Major Gifts Fundraising Training & Coaching Program | |||

Iconic Impact: A-to-Z Organizational Capacity-Building Training & Coaching | |||

Impact Optimization Blueprint: Unlock Your Potential & Drive Results | |||

6-Month Mastermind Membership |

Secure Your Investment with Nonprofit Auto-Pilot | Cell | Cell | Cell |

100% Done-for-You Managed Annual Entity & 990 Tax Filings | Cell | Cell | Cell |

Mission HQ Portal: Continued Access to Everything Listed Above, plus: | Cell | Cell | Cell |

Flight School: New Training Content Added Monthly (request and vote on topics!) | Cell | Cell | Cell |

Running Your Nonprofit Back-Office: Management Tools Training | Cell | Cell | Cell |

Technology & Website Training | Cell | Cell | Cell |

Compare Packages

Identify the INP package and services that fit your needs and then started.

-

Enterprise

-

501(c)4 & others

$877 or 320x3

Frequently

Asked

Questions

Have questions about something else? Call 855-893-3093 or or email us at success@instantnonprofit.com

Already a customer? Reach out to our your customer specialist team at support@instantnonprofit.com

Just the FAQs...

For the past decade, the average IRS approval time ranged from 10 to 18+ months - but even with the Full 1023 Application for 501(c)3 Tax Exempt Status, Instant Nonprofit files average 4 - 6 months, eliminating 1/2 to 2/3 of the delay for our family of founders. At this time, the average approval time for Instant Nonprofit Streamlined customer applications is 4 to 8 weeks.

Over the course of filing thousands of 501(c)3's, we've built up a body of expertise when it comes to using the right formula for fast approval. Just as we promise to be as human as possible with our customers, we do the same with the good folks at the IRS.

InstantNonprofit offers basic fundraising training & resources, 100% free upon purchase of one of our 501(c)3 Formation packages.

We also offer professional fundraising training through a long-time partner, who raises tens of millions for a broad array of causes.

Finally, we have a growing list of vetted grant writers who are available for introductions.

Some customers approach InstantNonprofit for our services, hoping that they can utilize an LLC or other entity formed independently prior to engaging us.

It’s important to note that the LLC entity type is not compatible with a 501(c)3 nonprofit; if you mistakenly started an LLC for the purpose of taking a step toward starting a nonprofit, it will need to be dissolved (we can help with this).

The correct type of entity is the Nonprofit Corporation (called a Non-Stock corporation in Virginia).

It's also important to note that even in cases where the correct entity type was filed, there is also required addenda (Purpose and Dissolution Clause), without which the IRS will reject your application.

If you filed a Nonprofit Corporation but failed to add the required language prior to starting with us, don't worry! We'll carefully examine your documents and file the proper amendment at no charge (not including government fees).

Also any EIN that is or was assigned to another entity at any time is NOT able to be applied to your new nonprofit - a new one must be obtained.

The BEST thing to do is NOTHING - it's usually better to start fresh with InstantNonprofit - because we do it all FOR you!

Yes, you may choose to be reimbursed (your nonprofit can pay you back after it raises funds or receives a grant), or you can choose to write it off as a charitable donation on your personal or business income taxes.

Keep receipts for such expenditures, and it's wise to create a paper trail, such as an invoice or acknowledgement of the expense provided by the nonprofit to the source of funds.

The IRS has created two paths to 501(c)3 tax-exempt status based on expected donations:

Organizations confident that they will raise more than $50,000 in the current tax year, or any of the following two tax years (these qualify for our Enterprise Plan)

One for organizations with expected donations below $50,000/year (or do not have a clear path to exceed that amount (these qualify for our Express Plan)

About 88% of our customers qualify for Express, while the other 12% choose Enterprise. The IRS 501(c)3 designation is the same.

If you choose the Express Plan and then exceed your wildest fundraising dreams, there is no penalty, and you do not have to re-file a thing! You will simply report your donations to the IRS in the following year as normal.

Your investment in service fees and government filing fees is visible on the following page when you click "get started".

Yes. You can build a strategic partnership with your for-profit and nonprofit, however, your nonprofit will be set up as it’s own entity and operate separately from your for-profit.

Nothing.

While the Enterprise package is designed for larger organizations that anticipate donations exceeding $50,000 in years 1, 2 or 3, and the Express is for organizations expeting to fall below $50,000, there are no penalties for Express customers who exceed those numbers.

The IRS does not come back and make you file another application. You simply must report your revenues on the appropriate 990 tax form.

Why InstantNonprofit

We don't just start your nonprofit, we finish it!

Start Fundraising Immediately

You don't need to wait for IRS approval. We provide the documentation to start now!

Board Meetings & Governance Docs

The only 501(c)3 service which includes Board minutes, resolutions and training.

EIN, Bylaws, Articles Conflict Policy....

...and much more! No other service puts this level of detail and care into YOUR success.

Customer Support & Mission HQ POrtal

All step-by-step training, completed documents, & caring support in one place.

Our social impact

At InstantNonprofit, giving back is part of our mission. Through our foundation, we support causes that make a real difference in the lives of the most vulnerable. Currently, we're helping families devastated by Hurricane Helene rebuild their lives, focusing on providing direct assistance to restore shelter in the hardest-hit areas. Together, we're bringing hope and stability to those who need it most. Join us in making a lasting impact where it’s needed most.

Join us in our efforts, and we'll share real-time updates from those impacted positively through our shared contributions!

We're on a Mission

InstantNonprofit was born with a purpose—and that purpose has only grown stronger. From our founder to every member of our team, we share a belief that the old ways aren’t working. Long-standing institutions, out-of-touch governments and big corporations are no longer trusted to point the way forward.

It is inside this disruption that we can chart a better path forward. It’s about connection, cooperation, and meaningful action—not waiting for someone else to act but empowering each other to create the change we want to see. We believe in the strength of community and the impact of rolling up our sleeves to forge a future of interdependence and shared progress. Let's do this - together!

"Be the change you wish to see in the world." – Gandhi

Avoid mistakes

and delays

We'll give you easy to understand action steps to make starting your nonprofit a breeze!

What they're saying