Excellent 4.8 out of 5

Start Your 501(c)3 in Minutes: IRS Approval Guaranteed & Fast

Trusted by 4000+ Nonprofits Operating Worldwide

Not Just Another Filing Service

10 Epic Reasons to Partner with InstantNonprofit

- 1We Don’t Just Start We Finish

Some companies advertise too-good-to-be-true prices with confusing offers that don't even include the 501(c)3 IRS application. Others leave you stuck with confusing government questions that don't make the process easy, leaving customers stuck in the middle. We walk you through every step of the way, with an average customer work and review time of 17-28 minutes to complete the entire process. So, start with us and hit the "DONE" button!

- 2IRS Approval or DOUBLE your money back

How can we have a 100% approval record for nonprofit IRS tax-exempt applications? We make sure from the start that your mission is eligible, and that the information we submit on your behalf is clear, concise, and accurate. And unlike other companies, if the IRS randomly pulls YOUR application like a TSA airline frisk, we handle the entire "IRS Information Request" process and at ZERO cost and zero hassle to you. Because it shouldn't be hard to do good.

- 3Yes, you can raise tax-deductible donations BEFORE IRS approval!

One of the biggest challenges for new nonprofits is convincing donors their contributions are tax-deductible while waiting for IRS approval. We’ve got you covered! Every customer who works with us gets a professionally crafted IRS memorandum included in their package. This document explains how donations are retroactively tax-deductible from the date your nonprofit was founded—so you can start raising funds with confidence right away.

It's one more reason we’re trusted to guide nonprofits through the process, ensuring your mission gets the support it needs without delay.

- 4Get Your Key Documents Fast, and Know How to Use Them

Managing a nonprofit shouldn’t be a mystery. That’s why we include a comprehensive suite of customized documents and templates in your service package, covering everything from board meeting minutes and resolution templates to donation receipts and conflict of interest policies.

These documents aren’t just tools for today—they’re designed to serve you infinitely into the future. Written in clear, simple language, they empower you with inherent training as you use them, building your confidence and understanding of nonprofit management with every step.

This approach reflects our mission to demystify nonprofits and create effective leaders for good. By equipping you with resources that are both practical and empowering, we set you up for long-term success, so you can focus on the impact you’re here to make.

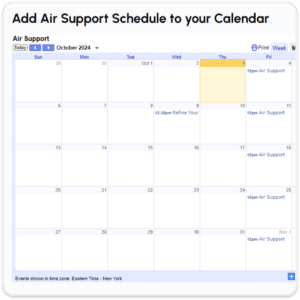

- 5Mission HQ: Your Command Center for Success

Nonprofit HQ is the centerpiece of your Nonprofit Launch Package—a secure, all-in-one portal where you’ll access every resource, tool, and guide we provide to launch and grow your nonprofit. This is where all the massive value we deliver comes together, step by step. From tailored templates like board resolutions and donation receipts to detailed instructions and clear video overviews, Nonprofit HQ ensures you have everything you need in one place. It’s designed to simplify the process, build your confidence, and grow with you, becoming your trusted hub for managing and expanding your nonprofit’s impact.

- 6Our Launch Plan Guides Your Entire Experience

Imagine knowing exactly what to do at every step of your nonprofit journey. That’s the power of the Launch Plan. While our team takes care of filings, legal work, and everything we can do for you, the Launch Plan ensures you’re never in the dark about what’s happening or what comes next.

With clear guidance on essential tasks—like running your first board meeting, opening a bank account, and providing donor receipts—you’ll feel confident and in control. The Launch Plan bridges the gap between what we do and what only you can do, creating a seamless partnership that keeps you informed and focused on your mission.

- 7Experienced Specialists Who Care About Your Mission

Starting a nonprofit is a big step, and you deserve more than a one-size-fits-all service. That’s why we’ve built a team of experienced, compassionate professionals who are as invested in your success as you are. Every question, every document, and every step of the process gets the care and attention it deserves.

We’re not just checking boxes or churning out paperwork—we’re here to ensure you feel confident, supported, and prepared at every turn. Our team is with you because we believe in the work you’re doing, and we know the difference it will make - and it’s exactly why we’re proud to be the team behind thousands of successful nonprofit launches.

- 8Focus on Your Mission, Not Red Tape

Turning the often painful and confusing process of creating and filing 501(c)(3) paperwork into something easy, efficient—and maybe even fun(!)—takes more than a slick website or off-the-shelf software.

Some companies copy-paste the dense, confusing language from government forms, slap it online, and call themselves a "filing service." To us, that’s not just lazy—it’s a disservice to people like you who are trying to do something meaningful.

We take a different approach. Our team translates bureaucratic jargon and legalese into plain English, breaking it down step by step so you feel confident, empowered, and in control. We’re here to do more than just help you file paperwork—we’re here to help you step into your mission with the kind of clarity and confidence that makes you feel unstoppable.

Because when you work with us, it’s not about filling out forms—it’s about transforming into the superhero your nonprofit needs to thrive.

- 9Built by Nonprofit Founders, for Nonprofit Founders

In a world full of corporate robots and private equity pirates who see people as numbers and missions as markets, we’re here to bring humanity back to the nonprofit world. We’re not some faceless tech company or soulless filing machine—we’re real people who have walked this path ourselves.

We know what it’s like to take the leap of faith to start a nonprofit, to fight through the red tape, and to dream big about making a difference. That’s why everything we do is built around your success. We’ve poured our experience, passion, and deep understanding into creating a process that’s not just efficient, but empowering.

When you work with us, you’re not working with paper-pushers or profit-hungry corporations. You’re working with people who care—people who have been where you are and who are committed to helping you turn your mission into reality. Because making a difference shouldn’t feel like doing battle. It should feel like building a movement - let's do this together!

- 10Be Done in 27 Minutes, Flat

Want your part to be over in less than half an hour? With InstantNonprofit, it can be. In just 27 minutes, you can be on your way to nonprofit status, while we handle the rest. It’s faster than your morning coffee run.

Which path to IRS Tax-Exempt Status is right for you?

Stats aren't everything, but...

trust InstantNonprofit to

bring their visions to life.

Start and Grow Your 501(c)3 with InstantNonprofit

Which path to IRS Tax-Exempt Status is right for you?

not ready to start?

Get your free Nonprofit

Bootcamp

Startup Experts

Transparent & Simple Pricing

Choose Your Package

For organizations projecting donations of less than $50k (or unknown amount) in any of initial three years

$877

or $317 x 3

For organizations anticipating bank deposits (of any kind) of MORE than $50k in any of initial three years

$1497

or $547 x 3

*For Special Nonprofits with a Single Source of Funding

$1997

or $737 x 3

*For Chambers of Commerce, Issue Advocacy, etc. Only

$1497

or $557 x 3

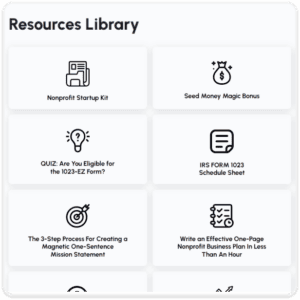

🚀 Launch & Grow Your Mission with the Right Resources, Right Now.

Stop digging through Google. Get instant access to our COMPLETE nonprofit founder resource library—100% free.

How to get started

Easy, 3-Step Process

Step 1

Take the 30-Second Quiz and Sign Up

Once you check out, you'll provide basic profile information about you and your new nonprofit, with step-by-step guidance along the way, so you can feel confident as you finish all work in 10-15 minutes on average!

Step 2

Your Specialists will Kick off your 501(c)3 Nonprofit Filing Process

After you verify your profile, we'll run all the checks, provide every document you need in your Mission HQ portal, and begin our done-for-you filings immediately!

Step 3

We take care of the rest so you can focus on your mission!

We'll deliver good news to your Inbox, and guide you through your well-organized filings and extensive customized support through your Mission HQ Portal - so you can do what you do best!

Sign up in just a few minutes - Most customers complete all work in 17 minutes or less

Every package includes done-for-you Articles of Incorporation, EIN, Bylaws, complete

IRS 1023 Application for 501(c)3 Tax-Exempt Status, complete Board Governance Toolkit, and a raft of valuable tools and templates - all with how-to guidance.

Our 200% Guarantee means you get IRS approval or double your money back.

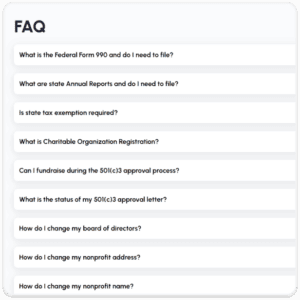

Just the FAQs...

For the past decade, the average IRS approval time ranged from 10 to 18+ months - but even with the Full 1023 Application for 501(c)3 Tax Exempt Status, Instant Nonprofit files average 4 - 6 months, eliminating 1/2 to 2/3 of the delay for our family of founders. At this time, the average approval time for Instant Nonprofit Streamlined customer applications is 4 to 8 weeks.

Over the course of filing thousands of 501(c)3's, we've built up a body of expertise when it comes to using the right formula for fast approval. Just as we promise to be as human as possible with our customers, we do the same with the good folks at the IRS.

InstantNonprofit offers basic fundraising training & resources, 100% free upon purchase of one of our 501(c)3 Formation packages.

We also offer professional fundraising training through a long-time partner, who raises tens of millions for a broad array of causes.

Finally, we have a growing list of vetted grant writers who are available for introductions.

Some customers approach InstantNonprofit for our services, hoping that they can utilize an LLC or other entity formed independently prior to engaging us.

It’s important to note that the LLC entity type is not compatible with a 501(c)3 nonprofit; if you mistakenly started an LLC for the purpose of taking a step toward starting a nonprofit, it will need to be dissolved (we can help with this).

The correct type of entity is the Nonprofit Corporation (called a Non-Stock corporation in Virginia).

It's also important to note that even in cases where the correct entity type was filed, there is also required addenda (Purpose and Dissolution Clause), without which the IRS will reject your application.

If you filed a Nonprofit Corporation but failed to add the required language prior to starting with us, don't worry! We'll carefully examine your documents and file the proper amendment at no charge (not including government fees).

Also any EIN that is or was assigned to another entity at any time is NOT able to be applied to your new nonprofit - a new one must be obtained.

The BEST thing to do is NOTHING - it's usually better to start fresh with InstantNonprofit - because we do it all FOR you!

Yes, you may choose to be reimbursed (your nonprofit can pay you back after it raises funds or receives a grant), or you can choose to write it off as a charitable donation on your personal or business income taxes.

Keep receipts for such expenditures, and it's wise to create a paper trail, such as an invoice or acknowledgement of the expense provided by the nonprofit to the source of funds.

The IRS has created two paths to 501(c)3 tax-exempt status based on expected donations:

Organizations confident that they will raise more than $50,000 in the current tax year, or any of the following two tax years (these qualify for our Enterprise Plan)

One for organizations with expected donations below $50,000/year (or do not have a clear path to exceed that amount (these qualify for our Express Plan)

About 88% of our customers qualify for Express, while the other 12% choose Enterprise. The IRS 501(c)3 designation is the same.

If you choose the Express Plan and then exceed your wildest fundraising dreams, there is no penalty, and you do not have to re-file a thing! You will simply report your donations to the IRS in the following year as normal.

Your investment in service fees and government filing fees is visible on the following page when you click "get started".

Yes. You can build a strategic partnership with your for-profit and nonprofit, however, your nonprofit will be set up as it’s own entity and operate separately from your for-profit.

Nothing.

While the Enterprise package is designed for larger organizations that anticipate donations exceeding $50,000 in years 1, 2 or 3, and the Express is for organizations expeting to fall below $50,000, there are no penalties for Express customers who exceed those numbers.

The IRS does not come back and make you file another application. You simply must report your revenues on the appropriate 990 tax form.