Fully Managed Nonprofit Payroll,

Compliance & Donations:

Hands-Free 501(c)3

It's easier than ever to automate your nonprofit every year- while erasing your student loans over 120 months!

Designed with PSLF in mind.

To help you take advantage of Public Student Loan Forgiveness, InstantNonprofit has introduced Hands-Free 501(c)3 to make it easier than ever to keep your nonprofit compliant for the long-term, so you can focus on making a difference in your community...

. . . without the nagging feeling that something is going to come back and bite you, such as:

- Second-guessing as to whether an overlooked detail will undo your Loan Forgiveness

- Weeding through repetitive government filings, not knowing which apply to you

- Battling the “phone robot” at bureaucratic agencies just to ask a simple question

- Paying lawyers, accountants or bookkeepers exorbitant fees

- Realizing, when it's too late, that your entity has been fined, your corporation has been dissolved, or your federal tax status has been revoked for non-compliance

We have served thousands of 501(C)(3) customers over the past 5 years, and we understand the challenges of maintaining your nonprofit. The good news is that we help solve ALL of them in our Hands-Free 501(c)3 Annual Maintenance Package!

Hands-Free 501(c)3: One unified service. 3 elements.

Dozens of pain points of managing your nonprofit, solved.

Element #1: Done-For-You Payroll & DoE Employment Verification ($1164 value)

Get Paid so you can Qualify for PSLF and avoid tax confusion

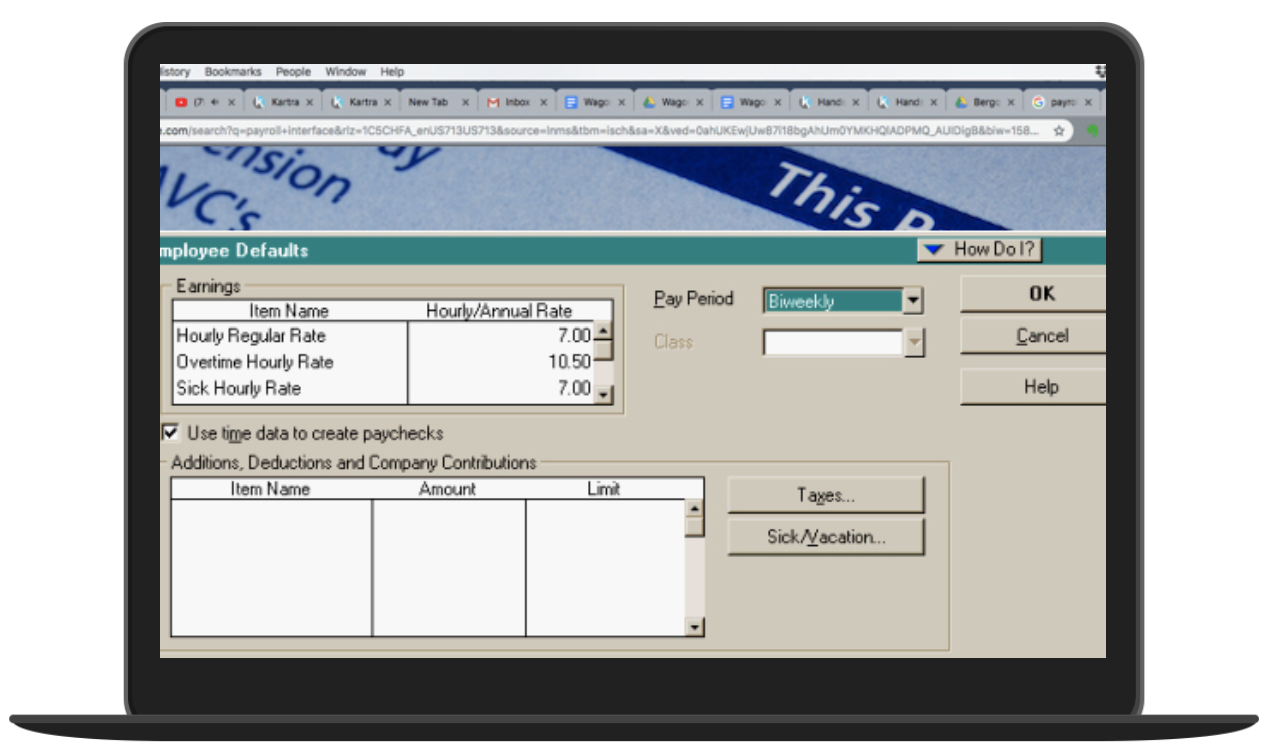

- Zero-effort payroll. Our payroll app puts the power in your hands when you want it, while running automatically in the background 24/7/365; 100% done-for you onboarding and then set-and-forget!

- We handle it all: Unemployment registration, IRS forms, pay stubs, quarterly tax payments, end-of-year W-2's and 940/941's. Scroll down to FAQ's for details.

- NEW! Annual Review & Execute Employment Verification so you never miss a beat when if comes to your Department of Education Annual Recertification process!

Element #2: Board Management & Operational Support ($397 value)

No-Hassle - Only the Features You Need for PSLF

- Annual Board Meeting & Management Support. Choose easy-to-follow, detailed Board Management Training, or have one of our experts set up a Zoom to facilitate & document your required Annual Board Meeting live, via video link.

- Corporate Governance Documents Package with pre-written, pre-formatted templates keep you in your practice - not on your computer after hours trying to figure it all out

Element #3: Annual State & Federal Compliance ($599 Value)

Year-Round Maintenance, on a Schedule

- We’re here to help keep you focused on YOUR goals, by managing all required compliance filings for you - including any & all notices from the State and IRS.

- We'll file your Annual 990 "Tax Return" as well as your State Periodic Report (due date varies by state) and other required filings (scroll to FAQ for details).

- You'll Have Peace of Mind by providing a growing Knowledge Database and FAQ to answer most questions about Compliance and Maintenance of your nonprofit.

TWO BIG BONUSES: NEW! Donation/Payment Platform Setup & Monthly Training and Open Q&A ($1567 value)

Avoid Attorney and Accounting Fees and Grow your PSLF Practice!

- Add Patients to your Nonprofit Practice: Once you've created your nonprofit practice, you'll need to add patients and accept payment to support it! We'll periodically share "what's working" among our pool of practitioners growing their patient base.

- The "Everything Else" factor: Today, it's not just about "the plan" - you need to be covered for the unplanned. So, when you have a nonprofit question or an issue, you don't need to rack up attorney or accountant fees - just bring it to us!

- Every month, we'll host a live "Open Q&A" on any topics that you want to cover, while we also cover topical training sessions to help you with community outreach, fundraising, add an employee, or put volunteers to work to further your mission.

Mark Leonard TV Producer and Nonprofit Founder

"I've worked in large nonprofit operations - and I know the difference between what I am good at, and what I need help with - and I knew to call InstantNonprofit."

You're just a few clicks away...

STEP 1: Book a call or select your payment option below

Before you book a call, be sure to check out the FAQ below, which may save you time and allow you to feel comfortable signing up right away!

STEP 2: Provide 501(c)3 and employee information

We'll onboard you with a few simple forms, verify all your information, and start uploading good news and vital documents to your shared folder!

STEP 3: Get paid, qualify for PSLF, and let us take care of the rest.

We'll establish your Compliance calendar, file your annual IRS 990 Tax Return, provide pay stubs, and file all payroll taxes and reports.

Technology backed up by real, actual humans!

Of course, we strategically use technology to make this as easy and reliable as possible - but sometimes, there's just no substitute for an in-charge, "Let-me-take-care-of that" human.

When things are working, you won't need to call us - but when you do, we're here for you!

WE ALREADY MADE YOUR 501(c)3 FORMATION EASY

NOW LET US HANDLE THE REST

You’re here to make the world a better place, and get your student loans ERASED! We’re here to help keep you focused on YOUR goals, by taking all of the other nonprofit maintenance and compliance burdens off your shoulders over the next several years.

Just like our 501(c)3 Formation service, we have designed this service to provide a ton of value for a moderate cost, and a super-easy and streamlined experience - so you can stay focused on your mission! No more worry or last minute calls to an accountant or lawyer - and no big fees!

Includes your 990-N Tax Return, Annual Report and/or Statement of Information, Certificate of Good Standing (or its equivalent) in your state, and provide live Q&A support through 2020.

What Customers are Saying about Hands-Free

“Everyone needs Hands-Free! Me most of all..."

Guys, you've been with me since I started, and I love how easy and streamlined it was to get started with Incorporation and Tax Exempt Status. But I'm not the greatest at keeping up with annual bureaucratic filings and paperwork. So I REALLY appreciate you rolling out this service - it is just what we all need!

Codi Woodman

- Serial Nonprofit Founder, Minnesota

“As an accountant, I know how people need Hands-Free!"

“Not only have I recommended InstantProfit for 5 years and appreciate their level of excellence, I ALSO know from helping people lower their tax burden, people often get in trouble forgetting to file their IRS 990 and Annual Report!"

John Boyle | EA, CTC

- Tax Planner and Advisor, Arizona

“InstantNonprofit will do the hard work for you."

“I came home and found my acceptance letter already there and I went to tears. If I had been bogged down trying to figure out the paperwork I wouldn’t have been able to launch. It’s the best investment I made for my nonprofit, hands down."

Sarah Downey Robinson

- Founder, Rise Up Yoga, Colorado

In 17 minutes (the average on-boarding time), you could be worry-free in maintaining the requirements for loan forgiveness by setting your nonprofit on auto-pilot

Total Value Exceeds $3,727

Best value: Save $314 by making a single annual payment

(Click to Choose Annual Plan)

Spread the payments as you build your nonprofit (12-month contract)

(Click to Choose Monthly Plan)

100% Secure Transaction

Hands-Free Maintenance Q&A

(click to expand)

- Payroll (Value $40/month = $480/year): Once we complete our set-and-forget process, we’ll manage your withholding and payments for taxes, and send a report for your files. Payroll services also include:

--> IRS 940 and 941 Filings: We’ll handle your periodic Federal Unemployment Tax and Wage Reporting, and upload reports to your secure account automatically.

--> W-2’s: We’ll issue and send W-2’s ahead of time.

--> Income Tax, Fed, FICA, & other deductions as required. - Unemployment & Disability (Value = $175): No matter the rules in your state, we’ll handle registration with the unemployment system and get you set up with the minimum required disability insurance.

- IRS 940 and 941 Filings: We’ll handle your periodic Federal Unemployment Tax and Wage Reporting, and upload reports to your secure account automatically.

- Annual or Periodic Report/Statement of Information (Value = $145): We’ll keep your organization in Good Standing by filing your Periodic Report, which states rely on to know the organization is still operating.

- Charitable Solicitation Registration - if applicable (Value = $225): Depending on the requirements in your state, we’ll keep you on the right side of the law by keeping you fundraising compliant.

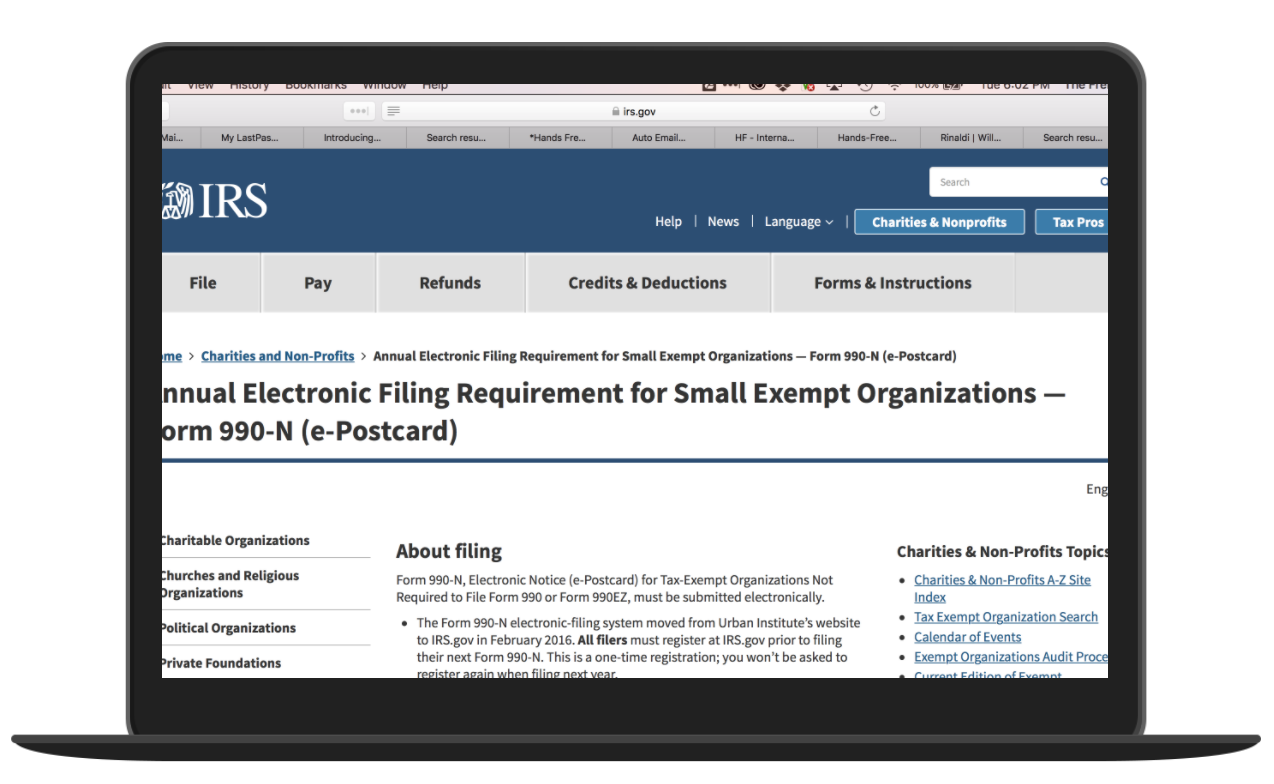

- Annual Filing of IRS Form 990 Tax Return (Value = $200): We’ll file your IRS Form 990 on or before the due date, which is the primary requirement to maintain IRS 501(c)3 Tax-Exempt Status.

- Annual Board Meeting Facilitation (Value $250): Once each year, we’ll schedule, facilitate (live via video), secure signatures, and upload documentation for your required Annual Board Meeting.

- Monthly “Ask Us Anything” Live Video Coaching ($100 per month or $1200 per year): You and/or your board will have the opportunity to hop on for live coaching once per month and get any question answered.

Here's what's NOT included, or is limited:

- The vast majority of states/geographies are covered for all required state filings. New York and Washington State (and perhaps 1-2 others based on emerging/recent legislation) have unique Family Leave laws, Hawaii has an Excise Tax Exemption, and a small percentage of localities or special districts have small, local tax programs and regulations. These require the nonprofit managers/directors to register directly. These are not included.

- Specific nonprofit questions and general consulting is dedicated to the bi-monthly coaching sessions included in the program. If you'd like more 1:1 help, we're happy to speak with you about our additional consulting services we provide for social entrepreneurs.

- If your revenues exceed $50,000 a small 990/tax return preparation fee will apply.

- If you've been in business prior to coming on board with us, and you missed a deadline or are out of compliance, we'll fix it, but reasonable fees will apply

- We do not answer questions about PSLF particularities - that is Ian Hoffman's department. We want you to have the best info available.

- Customers are resposible to possess basic technology proficiency and cannot spend hours cobbling together poor quality phone pictures of documents.

- You are responsible to send all relevant snail mail, or other documents required, via email after scanning them in high quality.

- Customers are expected to read our emails & communications, as we do need authorizations and decisions to be made, on occasion.

This version of Hands-Free was exclusively designed for Ian Hoffman’s clients – meaning the program would fit a specific niche of Student Loan Forgiveness program whose nonprofits would uniquely match the following criteria:

- Limited categories of income (donations and fee-for-service – maximum three)

- Limited categories of expense (payroll and 1-2 others – maximum three)

- Single-employee (W-2) organization (maximum two)

- One paycheck issuance per month

- Payroll falls below threshold requiring Federal tax withholding

- Revenues below $50,000/year (eligible for 990-N Annual Information Return)

- One board meeting annually to comply with minimum governance requirements

- No broad, public fundraising (does not meet national solicitation requirements)

This version of Hands-Free was exclusively designed for Ian Hoffman’s clients – meaning the program would fit a specific niche of Student Loan Forgiveness program whose nonprofits would uniquely match the following criteria:

- Limited categories of income (primarily fee-for-service, donations and/or loans – maximum three)

- Limited categories of expense (payroll and 1-2 others – maximum three)

- 1-2 employees (W-2) organization (maximum two)

- One paycheck issued per month

- Payroll falls below threshold requiring Federal tax withholding (about $42,000)

- Revenues below $50,000/year (eligible for 990-N Annual Information Return)

- One board meeting annually to comply with minimum governance requirements

- No broad, public fundraising (does not trigger national solicitation requirements)

- Your bank must allow "guest access" or limited, passive user account access so we can download bank activity and reconcile your books

Having created and assisted in myriad ways with thousands of 501(c)3’s, we always welcome CPA and/or attorney review. That said, our mission is to empower founders with an appropriate level understanding of their own organizations through clear, consistent reporting - one should not need an MBA to run a small company or nonprofit!.

Through customer feedback and an eye toward simplicity, we continue to refine and simplify our process and reporting format, so that anyone with the most basic level of understanding of financial terms will be able comprehend your organization’s finances from a glance at your financial reports.

Also - and perhaps equally significant - the 990 information return, which essentially replaces your organization’s “tax return”, does not require report any financial numbers whatsoever, as long as the annual revenues remain below $50,000 per tax year.