Your Student Loan Forgiveness Nonprofit

100% Done-For-You

Get your loan right, then work for the 501(c)3 that YOU create, with everything you need - so you can serve the community while qualifying for PSLF!

Trusted by forward-thinking Nonprofits around the world

Along with 3,000+ other nonprofits across the U.S. & throughout the world...

Start any type of Tax-Exempt Nonprofit in 3 steps

1. Click "Get Started"

Choose a 501(c)3 plan based on your type of nonprofit.

2. Enter Your Information

Provide basic information so we can submit your filings.

3. Relax! We do the rest.

You'll receive updates, approved documents & IRS 501(c)3 letter

Most customers complete all their work in under 20 minutes!

InstantNonprofit makes the legal end of starting a 501(c)3 nonprofit prompt, professional, and painless!

At Exponential, they're our go-to solution for forming new nonprofits - while we focus on our mission.

All Plans Come With Our 5-Point Quality Guarantee

Join the Ranks of our Empowered Nonprofit Founders!

Nobody should experience self-doubt and confusion when starting a nonprofit organization.

There’s no excuse for your calling to go unfulfilled and your mission to fail, simply because of government red tape and misleading information on the internet.

That's why we operate with 100% transparency and careful attention to every detail - so you can focus on your mission.

If something does come up, though, we have your back with our 5-Point Quality Guarantee.

This is why founders consistently give us A+ BBB Ratings, 5-Stars on Facebook, and awesome reviews!

Our Commitment: Your 5-Point Quality Guarantee

✓ IRS Approval Assurance: We take you from Idea to IRS 501(c)3, guaranteed. Don't be fooled by piecemeal offers.

✓ No "Brain Damage": Easy-to-use technology, no confusing paperwork. Your caring Specialist handles your file A to Z.

✓ Done-For-You: Check out, create your profile, & authorize work - and you're all done! We handle everything from there. Most customers can complete all this in under 20 minutes.

✓ No Secrets: No hidden fees, no surprises! You 'll know what to expect, how it works, and we'll update you along the way.

✓ Pay-It-Forward Policy: Your feedback helps us constantly improve, so we can pay-it-forward to our next Founder.

Start a 501(c)3 nonprofit for as little as $247 today!

Don't worry! Everything is included - backed by our IRS Approval Guarantee.

What's Included? (Hint: Everything you need!)

Our 501(c)3 Formation plans include EVERYTHING you need, in three key areas:

1. Start with State & Federal Filings

Includes bylaws, all policies, schedules, & addenda

✓ Nonprofit Articles of Incorporation in your State

✓ EIN - Employer Identification Number

✓ IRS Tax-Exempt Application (Form 1023)

✓ All required Schedules and Addenda

✓ Customized Bylaws and Required Policies

✓ Expedited processing of every file

2. Nonprofit Founder's Playbook:

Management & Board Training

Because "Comprehensive 501(c)3 Corporate Governance &

Management Guides " sounds SO boring...

Here are some of our clients' favorite blueprints:

✓ How you can legally fundraise NOW (pre-IRS approval)

✓ Step-by-step training on recruiting & manage a board

✓ Toolkit & training so you can run annual meetings like a pro

✓ How to set maintenance filings on auto-pilot

✓ ... And much more

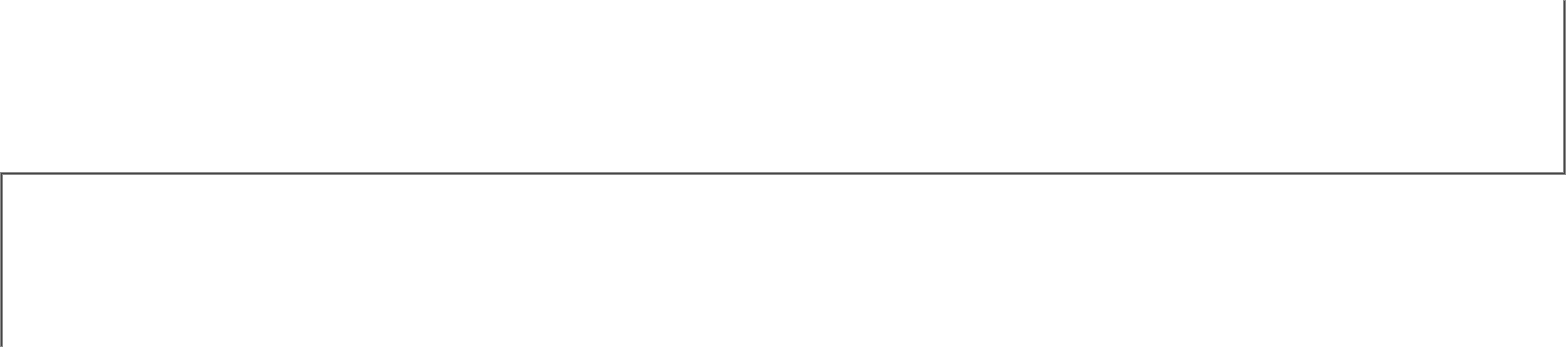

3. One-Stop Shop: Your Account Portal

Easy, secure access to ALL of your resources!

✓ All of your Approved Nonprofit Documents

✓ Founder’s Playbook Video Training

✓ Nonprofit Bootcamp (Enhanced videos & worksheets)

✓ How to Run a Board Meeting in 30 Minutes (Video Training)

✓ Comprehensive (and growing) FAQ & Knowledge Base

✓ Worry-free navigation of annual maintenance & more!

Expert customer service. By real humans who care about your mission.

Your caring Specialist handles your nonprofit file A to Z.

You'll receive consistent email updates and phone support from the same Nonprofit Specialist who will guide your 501(c)3 file all the way through our proven process until your 501(c)3 status gets successfully approved.

The IRS website is like a kick in the throat. I needed a solution for the huge paperwork problem.

InstantNonprofit does the heavy lifting, so you can focus on your purpose. It's the best investment I made for my nonprofit, hands down.

Sarah Downey Robinson

Founder, Rise Up Yoga, Denver

Ready to make YOUR difference and finally launch your Nonprofit?

Trusted by forward-thinking Nonprofits around the world

Along with 3,000+ other nonprofits across the U.S. & throughout the world...

Red tape is the enemy of countless great ideas. It’s a shame that people shy away from pushing forward with these ideas because they’re unfamiliar with and rightly intimidated by the morass of paperwork and protocols necessary to start any type of entity.

When it comes to starting a nonprofit organization, that red tape is even more daunting. That’s too bad, because one thing that nonprofits share is the ideal that they’re trying to make the world a better place.

If only there were a resource that people with these ideas could make use of to obtain nonprofit support packages that would help them get things up and running…

If this sounds familiar and you’re searching for this type of help, you’ve come to the right place. Instant Nonprofit offers nonprofit support packages and general nonprofit startup help that will not only help you get that initial paperwork done, but it’ll help you build your organization.

Your startup legwork isn’t done when you properly register with the government – in fact, in some respects it’s only beginning. There are a lot of compliance requirements for any nonprofit, and our nonprofit support packages will help you maintain that compliance and keep things moving forward as you envisioned in the first place.

Go ahead and take a look at what we have to offer below, as well as some of the feedback from people we’ve helped in the past. 501c3 startup help is a valuable service, and it’s one that we hope you’ll take advantage of with us so that you can do your part in making the world a better place.

All Orders Include a 100% IRS 501(c)3 Approval Guarantee

Receive your IRS Approval, or your money back. End of story.

At Instant Nonprofit all we do is file for nonprofit status and help good people, just like you. We’ve helped thousands of people make their dream of a nonprofit a reality.

Nobody should experience self-doubt and confusion when starting a nonprofit organization.

There’s no excuse for your calling to go unfulfilled and your mission to fail, simply because of government red tape and misleading information on the internet.

That's why we operate with 100% transparency and careful attention to every detail - so you can focus on your mission. If something does come up, though, we have your back with our 5-Point Quality Guarantee. We'll implement our proven process to get your nonprofit approved quickly by the IRS.

This is why founders consistently give us A+ BBB Ratings, 5-Stars on Facebook, and awesome reviews!

Rest Assured With Our 5-Point Quality Guarantee Included With All Plans...

✓ IRS Approval Assurance: We take you from Idea to IRS 501(c)3, guaranteed. Don't be fooled by piecemeal offers.

✓ No "Brain Damage": Easy-to-use technology, no confusing paperwork. Your caring Specialist handles your file A to Z.

✓ Done-For-You: Check out, create your profile, & authorize work - and you're all done! We handle everything from there. Most customers can complete all this in under 20 minutes.

✓ No Secrets: No hidden fees, no surprises! You 'll know what to expect, how it works, and we'll update you along the way.

✓ Pay-It-Forward Policy: Your feedback helps us constantly improve, so we can pay-it-forward to our next Founder.

Not ready to start yet and want to learn more about how to start your nonprofit?

Attend our free training, "How to take your Nonprofit Idea to IRS-Approved 501(c)3 Tax-Exempt Status Without Headaches, Delays or Legal Fees" to learn more about how you can officially start your nonprofit organization...

Frequently Asked Questions

InstantNonprofit offers basic fundraising training & resources, 100% free upon purchase of one of our 501(c)3 Formation packages.

We also offer professional fundraising training through a long-time partner, who raises tens of millions for a broad array of causes.

Finally, we have a growing list of vetted grant writers who are available for introductions.

Some customers approach InstantNonprofit for our services, hoping that they can utilize an LLC or other entity formed independently prior to engaging us.

It’s important to note that the LLC entity type is not compatible with a 501(c)3 nonprofit; if you mistakenly started an LLC for the purpose of taking a step toward starting a nonprofit, it will need to be dissolved (we can help with this).

The correct type of entity is the Nonprofit Corporation (called a Non-Stock corporation in Virginia).

It's also important to note that even in cases where the correct entity type was filed, there is also required addenda (Purpose and Dissolution Clause), without which the IRS will reject your application.

If you filed a Nonprofit Corporation but failed to add the required language prior to starting with us, don't worry! We'll carefully examine your documents and file the proper amendment at no charge (not including government fees).

Also any EIN that is or was assigned to another entity at any time is NOT able to be applied to your new nonprofit - a new one must be obtained.

The BEST thing to do is NOTHING - it's usually better to start fresh with InstantNonprofit - because we do it all FOR you!

Yes, you may choose to be reimbursed (your nonprofit can pay you back after it raises funds or receives a grant), or you can choose to write it off as a charitable donation on your personal or business income taxes.

Keep receipts for such expenditures, and it's wise to create a paper trail, such as an invoice or acknowledgement of the expense provided by the nonprofit to the source of funds.

The IRS has created two paths to 501(c)3 tax-exempt status based on expected donations:

- Organizations confident that they will raise more than $50,000 in the current tax year, or any of the following two tax years (these qualify for our Enterprise Plan)

- One for organizations with expected donations below $50,000/year (or do not have a clear path to exceed that amount (these qualify for our Express Plan)

About 88% of our customers qualify for Express, while the other 12% choose Enterprise. The IRS 501(c)3 designation is the same.

If you choose the Express Plan and then exceed your wildest fundraising dreams, there is no penalty, and you do not have to re-file a thing! You will simply report your donations to the IRS in the following year as normal.

Your investment in service fees and government filing fees is visible on the following page when you click "get started".

Yes. You can build a strategic partnership with your for-profit and nonprofit, however, your nonprofit will be set up as it’s own entity and operate separately from your for-profit.

Nothing.

While the Enterprise package is designed for larger organizations that anticipate donations exceeding $50,000 in years 1, 2 or 3, and the Express is for organizations expeting to fall below $50,000, there are no penalties for Express customers who exceed those numbers.

The IRS does not come back and make you file another application. You simply must report your revenues on the appropriate 990 tax form.

Start your 501(c)3 nonprofit for as little as $247 today!

Don't worry! Everything is included - backed by our IRS Approval Guarantee.